|

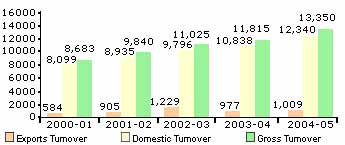

ITC ranked fifth in terms of gross sales in the Indian Private Sector in 2004-2005. Net

Sales grew at an impressive 18% during the year. The export turnover grew to Rs.1,009

crores. This signifies a CAGR of 14.6% over the last 5 years. All businesses in the ITC

portfolio are mandated to engage with overseas markets in a bid to test competitiveness

and seek growth opportunities. The ITC group’s contribution to foreign exchange

earnings over the last decade grew on a sustained basis, amounting to a total of USD 2.2

billion, of which agri exports accounted for USD 1.6 billion. Agri export earnings are an

indicator of ITC’s contribution to the rural economy through effectively linking the

farmers with international markets.

Turnover (Rs. Crores)

The ‘FMCG - Others’ segment recorded the highest growth in terms

of sales. This segment includes sale of Foods (Atta, Ready to Eat Meals, Biscuits,

Confectioneries), Garments Retailing, Greeting Cards, Stationery, Agarbatti and Matches.

ITC is of the view that the FMCG sector presents exciting long-term growth prospects, as

the underlying macroeconomic trend points to a compelling opportunity.

The Company’s market standing was significantly enhanced due to the

rapid expansion of product range across chosen categories. The Company’s trade

marketing and sales management processes, spanning multiple skills across diverse

categories, are acknowledged as the industry benchmark. |

|

*The figures of the Hotels business are not

comparable, as the figures of FY 2003-04 do not include figures of erstwhile ITC Hotels

Limited, now merged with ITC Limited, with effect from April 1, 2004.

|

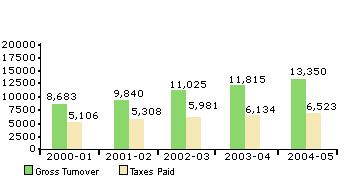

Contributing to the National Exchequer |

ITC’s contribution to the national exchequer is significant in terms of payment of

excise duties, luxury taxes, income tax and other rates and taxes. The share of ITC’s

contribution to the exchequer constitutes nearly 72% of its Value Added. In terms of

Direct Taxes, the Company’s contribution to the exchequer ranks amongst the top

companies in the private sector in India. ITC’s excise payments account for nearly 5%

of the total excise collection in India.

Turnover & Taxes Paid (Rs. Crores)

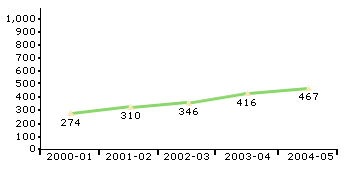

People are ITC’s unique source of competitive advantage. ITC’s Human Resource

strategies and policies are anchored in the belief that the quality and preparedness of

the human resource is the decisive differentiator. ITC’s HR strategies and policies

seek to build sustained market leadership and organisational vitality for continuous

regeneration and renewal, thereby creating enduring value for the stakeholder. ITC

believes that executive remuneration is an important instrument in attracting and

retaining talent, and remuneration/reward is a key component of the performance management

system. The Company recognises that value addition at a rate faster than competition can

serve as a key retention factor, while simultaneously developing capabilities for the

future.

Payroll Costs (Rs. Crores)

|