Economic Performance

Pension Obligations

Pension Obligations

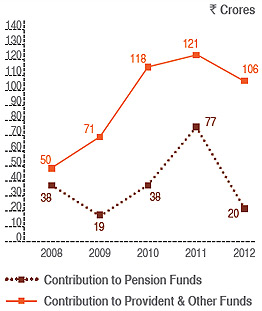

Employees’ Retirement Benefit Schemes include employee pension, provident fund and gratuity which are admnistered through duly constituted and approved independent trusts.

Provident Fund and Family Pension contributions in respect of unionised staff, as required by applicable statutes are deposited with the Government in a timely manner.

The pension plans and other applicable employee benefits obligations are determined and funded in accordance with independent actuarial valuation. Expected rate of return on plan assets is based on the current portfolio of assets, investment strategy and market scenario.

In order to protect the capital and optimise returns within acceptable risk parameters, the plan assets are well diversified. The funds are consistently sustained to meet requisite superannuation commitments.

Corporate Social Responsibility

Citizen First

ITC’s overarching aspiration to create large scale societal value while simultaneously delivering shareholder value is manifest in its strategy to enhance the competitiveness of its value chains which encompass the disadvantaged sections of society.

In pursuance of the Company’s policy on Corporate Social Responsibility (ITC’s CSR Policy detailed in the Policies & Guidelines section of this Report), ITC has crafted innovative business models that create larger and enduring value by not only generating new sources of competitive advantage for its businesses, but also in the process augmenting natural capital and sustainable livelihoods for the nation.

| Rs. Crores | |||

| 2009-10 | 2010-11 | 2011-12 | |

|---|---|---|---|

| Corporate Social Responsibility spends | 48 | 68 | 88 |

| Average Net Profits during three immediately preceding Financial Years (FYs) | 3028 | 3482 | 4104 |

| CSR spends as a % of Average Net Profits during three immediately preceding FYs | 1.57 | 1.96 | 2.14 |