Q4 FY18 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's 3-tier Governance Structure.

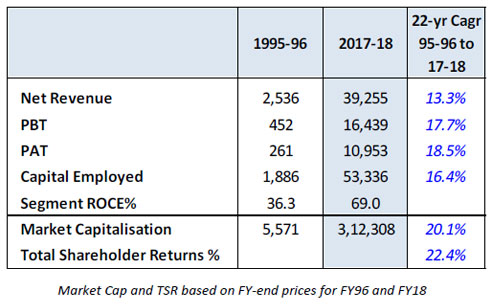

Q3. What is the Company's shareholder value creation track record?

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 1995/96 to 2017/18, Total Shareholder Returns have clocked compound annual growth rate of 22.4% significantly outperforming the Sensex (10.9%).

Q4. (a) Why has reported Gross Revenue from sale of products and services declined by 20.1% in FY18 as compared to FY17?

Answer: Consequent to the introduction of Goods and Services Tax (GST) with effect from 1st July 2017, Central Excise [other than National Calamity Contingent Duty (NCCD) on cigarettes], Value Added Tax (VAT) etc. have been replaced by GST. In accordance with Indian Accounting Standard - 18 on Revenue and Schedule III of the Companies Act, 2013, GST, GST Compensation Cess, VAT, etc. are excluded and NCCD is not excluded from Gross Revenue from sale of products and services for applicable periods. In view of the aforesaid restructuring of indirect taxes, Gross Revenue from sale of products and services for the year ended 31st March, 2018 is not comparable with the previous periods.

Q4. (b) What is the growth in Revenue for the year on a comparable basis?

Answer: On a comparable basis, Gross Sales Value (net of rebates/discounts) ('GSV') for the year grew by 4.5%. GSV includes Gross Revenue from sale of products and services and GST, GST Compensation Cess, Service Tax, VAT, Luxury Tax etc., as applicable for the reported periods.

Q5. Please provide a brief overview of FY18 results.

Answer: The Company delivered a resilient performance during the year which was a particularly challenging one due to a sharp slowdown in the economy, steep escalation in tax incidence on cigarettes under the GST regime, subdued demand conditions in the FMCG industry and supply chain disruptions caused during the transition to GST. The non-cigarette FMCG segment also had to contend with gestation costs relating to new products/categories and the ongoing restructuring of the retail footprint/trade terms in the Lifestyle Retailing Business. Shortage of leaf tobacco in Andhra Pradesh due to lower crop output on account of drought in 2016 and adverse crop quality, relative strength of the Indian Rupee vis-à-vis currencies of competing origins and limited trading opportunities in other agri-commodities weighed on the performance of the Agri Business. While there was an improvement in room rates, performance of the Hotels Business remained subdued during the year due to the overhang of excess room inventory in key cities and the impact of ban on sale of liquor at outlets in close proximity to highways in the first half of the year. The Paperboards, Paper and Packaging Business was also impacted by unabsorbed capacity in the value added paperboards segment, cheap imports and slowdown in end user industries such FMCG, liquor and pharmaceuticals.

On a comparable basis, Gross Sales Value (net of rebates/discounts) stood at Rs. 67081.92 crores, representing a growth of 4.5% driven mainly by the Branded Packaged Foods, Personal Care and the Education and Stationery Products Businesses offset by decline in Agri Business revenue due to the reasons as aforestated. Profit Before Depreciation, Interest and Tax (excl. Exceptional items) at Rs. 15540.98 cr. and Profit Before Tax (excl. Exceptional items) grew by 6.6% and 6.0% respectively.

Q6. (a). Why has 'Consumption of Raw Material etc. (net)' decreased by Rs. 186 crores during FY18 as compared to FY17?

Answer: Decline in Consumption of Raw Material etc. (net) reflects the decline in Agri Business revenue, stable input costs and strategic cost management initiatives such as higher usage of in-house pulp, recipe optimisation etc.

Q6. (b). Why has 'Other Expenditure' declined by Rs. 281 crores in FY18 as compared to FY17?

Answer: Other Expenditure for FY18 is lower mainly due to lower Rates & Taxes and Miscellaneous expenses.

Q7. What is the rationale for the Company's investments in the FMCG space?

Answer: ITC's entry into a wider range of FMCG products in recent years is in line with its strategy of creating multiple drivers of growth. The Indian FMCG industry is expected to grow rapidly driven by increasing affluence, urbanisation and a young workforce on the one hand and relatively low levels of penetration and per capita usage on the other. The Company seeks to participate in the exciting growth prospects of the FMCG industry by leveraging its institutional strengths in the form of deep consumer insight, proven brand building capability, manufacturing excellence, deep and wide distribution network, packaging and printing knowhow, agri-commodity sourcing expertise and cuisine knowledge.

Q8. Please provide an overview of the Company's progress in the new FMCG businesses. What is the Company's goal in the new FMCG businesses?

Answer: The FMCG industry faced another challenging year with demand conditions remaining sluggish for the fifth year in a row. The slowdown in the broader economy - as reflected by the marked deceleration in nominal GDP and private consumption expenditure growth - headwinds in rural demand and supply chain disruptions during the transition to the GST regime were manifest in the Company's operating segments in the FMCG space. The year also witnessed commodity prices settling at an elevated level, exerting pressure on margins.

Despite the challenging conditions prevailing during the year, the Company's FMCG-Others Businesses Segment Revenue at Rs. 11329 crores grew ahead of industry and recorded an increase of 11.3% (on a comparable basis) on a relatively firm base. While the second half of 2016-17 witnessed reduced consumer offtake and trade pipelines in the wake of adverse liquidity conditions, it is pertinent to note that the Company's FMCG-Others businesses were relatively less impacted.

Most major categories enhanced their market standing during the year. While Bingo! snacks, Aashirvaad atta and Dark Fantasy Choco Fills premium cream biscuits were the key drivers of growth in the Branded Packaged Foods Businesses, Engage deodorants, Vivel/Fiama soaps & shower gels and Savlon handwash fuelled strong growth in the Personal Care Business. The Education and Stationery Products Business posted a robust performance during the year led by Classmate notebooks, which consolidated its leadership position in the industry. However, the performance of the Lifestyle Retailing Business remained sluggish mainly on account of an early and prolonged 'end-of-season sale' in the wake of disruption to the trade during transition to GST and ongoing structural interventions to enhance operating efficiencies. Segment Results for the year improved to Rs. 164 crores from Rs. 28 crores in 2016-17 driven by enhanced scale, product mix enrichment and strategic cost management initiatives after absorbing the impact of sustained investment in brand building, gestation costs of new categories viz. Juices, Dairy, Chocolates and Coffee and costs associated with the ongoing structural interventions in the Lifestyle Retailing Business.

During the year, capacity utilisation was progressively scaled up at the Uluberia, Mysuru and Guwahati units that commenced operations in the second half of FY17. The Company commissioned two world-class Integrated Consumer Goods Manufacturing and Logistics Units (ICMLs) at Panchla, West Bengal and Kapurthala, Punjab. Significant progress was also made in constructing several other state-of-the-art owned ICMLs across the country to secure capacity and enable the FMCG businesses to rapidly scale up in line with long-term demand forecast. Currently, over 15 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

The Indian FMCG market is at an inflection point and the Company seeks to rapidly scale up the FMCG Businesses leveraging its institutional strengths viz. deep consumer insight, proven brand building capability, agri-commodity sourcing expertise, cuisine knowledge, strong rural linkages, a deep and wide distribution network and packaging know-how. In addition, the Company continues to make significant investments in Research & Development, focus on consumer insight discovery and harness digital technology to develop and launch disruptive and breakthrough products in the market place.

Q9. Please provide a revenue split of the FMCG-Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for over ~75% of Segment Revenue. The Personal Care Business and Education and Stationery Products Business account for nearly 9% and 7% each of Segment Revenues respectively.

Q10. What are the new FMCG categories that the Company is likely to enter over the short to medium term?

Answer: With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space.

The choice of category is guided by its growth prospects, profitability profile and the ability of the Company to effectively leverage its institutional strengths with a view to achieving leadership status within a reasonable time frame. Synergies with existing categories in terms of overlap of distribution reach, brand extension possibility, procurement efficiencies etc. are considered while choosing new categories.

The Company is in the process of scaling up its presence in Dairy & Beverages, Chocolates and Coffee.

Q11. What is the margin profile of the Branded Packaged Foods Business?

Answer: The Branded Packaged Foods Businesses of the Company comprise 'Confections', 'Staples, Snacks and Meals' and 'Dairy & Beverages'. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin is in the high single digit range for the Staples business (first full year of launch: 2002/03) while the same is in the mid single digit range for the Snack Foods business (first full year of launch: 2007/08) representing upfront investments towards category development and brand building.

Overall, the mandate for each category is to work towards achieving best-in-class margins within a reasonable period of time.

Q12. What is the margin profile of the Personal Care Products Business? When will it break-even?

Answer: The Personal Care Products Business presently comprises the 'Personal Wash', 'Fragrancing Products', 'Skin Care' and 'Antiseptic Liquid' categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q13. What are the Company's targets in the FMCG-Others space? What does the Company envision in terms of revenue and profits in this segment, over the medium and long-term?

Answer: ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories. In this regard, the Company is aiming for revenue of Rs. 100,000 crores from the new FMCG businesses by the year 2030.

Over the medium term, the Company seeks to grow revenues of each category within the FMCG-Others segment at a rate which is well ahead of industry. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins, progressively over the medium-term.

Q14. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through Acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

The Company's 'Savlon' and 'Shower to Shower' brands, acquired earlier, have been leveraged to strengthen its position in the personal care space by expanding its existing product portfolio and gaining access to newer consumer segments and markets. The offerings have garnered significant consumer franchise and are well poised for rapid growth.

The Company's 'B Natural' brand, acquired earlier, was leveraged to foray into the fast growing Juices category. B Natural range of juices, currently available in many exciting variants, has garnered impressive consumer traction in a relatively short span of time and is well poised for rapid growth.

The Company's recently acquired 'Charmis' brand has been leveraged to launch moisturising skin cream during Q2 FY18.

Q15. Please provide an update on the Company's progress in the FMCG-Others Segment during the year.

Answer: The Company's FMCG-Others Businesses Segment Revenue stood at Rs. 11329 crores and recorded an increase of 11.3% (on a comparable basis) on a relatively firm base as aforestated.

The Company sustained its position as one of the fastest growing branded packaged foods businesses in the country leveraging a robust portfolio of brands, a range of distinctive products customised to address regional tastes and preferences along with an efficient supply chain and distribution network that ensures benchmark levels of visibility, availability and freshness of products in the market. The Business implemented several initiatives encompassing cost management, supply chain optimisation, smart procurement and recipe optimisation which helped in mitigating the escalation in input costs and enhancing profitability.

In the Staples Business, 'Aashirvaad' atta posted healthy growth and continues to strengthen its leadership position in the market. This was achieved despite increasing competitive pressures triggered by the imposition of 5% GST on branded atta (compared to nil VAT in most States under the erstwhile tax regime) while non-branded atta (incl. branded atta on which actionable claim or enforceable right has been foregone voluntarily) remained at nil duty. During the year, the Business also had to contend with a concerted attack on Aashirvaad atta on social media with rumour mongers circulating malicious videos and falsely alleging that Aashirvaad atta contains plastic. The Business launched a 360 degree campaign to reassure consumers and dispel the baseless rumours surrounding Aashirvaad atta. The communication clearly highlighted that as per FSSAI standards, atta must contain not less than 6% of wheat protein on a dry weight basis and that elasticity is a natural property of the protein without which it is not possible to bind the atta. Simultaneously, complaints were filed with the police authorities and injunction orders restraining circulation of such videos on social media were also obtained from the civil court. These interventions helped in effectively mitigating the short-term impact of the malicious videos on sales momentum, with the brand staging progressive recovery subsequently. Powered by the trust reposed by over 2.5 crore households, the Company is confident of sustaining Aashirvaad's position as India's No. 1 atta brand going forward.

Supported by its new positioning, 'Created by Sun and Sea - pure just like nature intended it to be' and new pack design, Aashirvaad Salt posted robust performance during the year.

In the branded Spices category, the Aashirvaad range of spices registered steady volume growth. In line with its commitment to deliver products with the highest quality and safety standards to Indian consumers, the Business continued to reinforce the value proposition of the recently launched ITC Master Chef 'Super Safe Spices', which are tested for over 470 pesticide residues in accordance with European standards as compared to only nine required under Indian regulations.

In the Snacks and Meals Business, the 'Bingo!' range of snacks recorded robust growth during the year driven by Tedhe Medhe and potato chips. The Business achieved market leadership on an All-India basis in the Bridges segment driven by a robust portfolio of products under the Tedhe Medhe, Mad Angles and Tangles sub-brands. The potato chips portfolio recorded impressive market share gains and emerged as the leader in the South markets leveraging an optimised portfolio, revamped pack and fresh communication. During the year, the Business forayed into the extruded snacks segment with the launch of 'No Rulz' - a first-of-its-kind offer comprising four different shapes of the product in a single pack. The product has received excellent response and continues to gain traction with consumers. During the year, the Bingo! range was augmented with the launch of several variants customised for regional taste palates, viz. Mad Angles Kolkata Kasundi, Tedhe Medhe Lime Chatpata, Tomato Masti and Pudina Twist.

In the Instant Noodles category, YiPPee! noodles sustained its robust growth momentum during the year despite increasing competitive intensity including from several regional discount players. The year also saw the launch of 'Mood Masala' - an innovative variant comprising two masala mix sachets in a pack providing the consumer the option to add masala to 'match his mood'. Mood Masala received encouraging consumer response, further strengthening the brand imagery of YiPPee! amongst tweens and young adults.

The Confections Business scaled up operations and improved its market standing during the year. In the Biscuits category, the Business continued to focus on premiumising its product portfolio, enhancing brand affinity, strengthening the supply chain and expanding distribution reach. Consistent and impactful communication, coupled with focused marketing inputs helped improve penetration and brand health metrics. Dark Fantasy Choco Fills sustained its clear market leadership position in the super-premium creams segment across the country. Brand architecture in the biscuits category was optimised with the migration of Delishus & Yumfills under the Mom's Magic and Dark Fantasy brands respectively. The Business augmented its product portfolio in the health segment with the launch of 'Protein Power', a unique variant based on roasted Bengal gram flour and Digestive five grains biscuits under the Farmlite brand. The Mom's Magic range was expanded with the addition of 'Fruit & Milk' variant. In the Confectionery category, in line with its strategy of premiumising the portfolio, the Business launched several unique offers in the 'Re. 1 & above' price points including Cola Josh, Crunchy and Clear Candy under the Candyman brand, Jelimals Sour Slides and two exciting variants under the mint-O brand. These products have received encouraging consumer response.

In the Dairy & Beverages Business, the B Natural range of juices continues to gain traction amongst target consumers aided by a clutter-breaking media campaign, on-ground trial generation initiatives and visibility & availability enhancement drives. The journey towards making juices concentrate-free, which commenced last year with the launch of 'B Natural 100% Pomegranate Juice', continues with the entire range of B Natural juices being migrated to the 'not from concentrate' platform. This first-of-its-kind initiative in India, was anchored on the twin resolve to provide consumers a more nutritive and natural tasting experience and promote the use of fruit pulp procured from Indian farmers, thereby supporting the Indian farm and food processing sector. The Business also introduced 'Bael' and 'Phalsa' variants during the year catering to regional tastes and preferences which were well received by consumers. In the Dairy segment, 'Aashirvaad Svasti' Ghee was extended to Delhi NCR markets during the year, garnering increasing consumer franchise. During the year, the Business also forayed into the Pouch Milk segment under the 'Aashirvaad Svasti' brand in select markets in Bihar in the vicinity of the Munger dairy plant.

In the Chocolates category, the 'Fabelle' range of luxury chocolates was scaled up during the year with a view to redefining the luxury chocolate segment in India. The range is available in eight Fabelle Chocolate Boutiques located within ITC hotels and select outlets in premium malls and food stores. Product portfolio was augmented with the launch of two delectable variants of centre-filled chocolate bars - 'Hazelnut Mousse', & 'Dark Choco Mousse' which have received excellent response from discerning consumers. Towards deepening engagement with consumers, the Business launched a unique experience platform during the year christened - 'Fabelle Societe de Chocolat' - across Fabelle boutiques with Ms. Billie McKay, winner of MasterChef Australia 2015, as the mentor. 'Sunbean' gourmet coffee, launched across all ITC Hotels last year, continues to receive excellent response from discerning consumers and plans are on the anvil to scale up presence in the ensuing years.

The Personal Care Products Business delivered a robust performance and enhanced its market standing during the year against a backdrop of significant disruption to trade and supply chain following the roll out of GST. This was driven largely by sustained focus on innovation, product mix enrichment, expansion of distribution reach, proactive cost management and enhancing supply chain responsiveness.

The Business continued to focus on innovation and delight consumers by launching a range of exciting offerings during the year. In the Fragrance category, the recently launched innovative pocket perfumes - 'Engage ON' and 'Engage ON+' - designed to drive on-the-go consumption, garnered robust consumer traction. The Business also launched a Sport range of deodorants with long lasting fragrance and a selection of premium Eau de Parfum for both men and women. In the Personal Wash category, the Business introduced a unique Gel Crème range under the 'Fiama' brand combining the best of gel and cream for both soap and liquid bathing products, and Vivel Lotus Oil - a unique offering enriched with Lotus Oil and Vitamin E for soft glowing skin. 'Savlon' handwash continued to gain ground with the launch of a small pack at an attractive price point. These new innovations received excellent response from consumers during the year and were supported with refreshing communication and engaging consumer activations.

'Engage' recorded impressive gains in the Fragrance category, consolidating its leadership position in the women's segment and No. 2 position overall. The roll out of innovative pocket perfumes, Sport range of deodorants and the Eau de Parfums range have helped the brand grow its consumer equity significantly among both men and women besides premiumising the portfolio. 'Savlon' handwash recorded significant gains during the year across brand health metrics and emerged as the fastest growing brand in the market. In the bodywash segment, the 'Fiama' range of shower gels continued to garner increasing consumer franchise and is the fastest growing and the second largest brand nationally. The Business also launched moisturising skin creams under the recently acquired 'Charmis' brand and plans are afoot to strengthen the skincare portfolio in the near to medium term.

The Stationery industry was impacted during the year with the roll out of GST coinciding with the school opening season and trade operating with lower inventory levels due to uncertainties around the new tax regime. Despite these challenging conditions, the Business sustained its leadership position in the Indian Education and Stationery Products industry anchored on a portfolio of world-class products and brands.

The Business continued to leverage its dedicated product development cell and the Life Sciences & Technology Centre to develop & launch innovative and superior products in the market. During the year, the product portfolio was augmented with the launch of several new products including a spiral range of notebooks under Classmate, Classmate All Purpose Paper, 'Archimedes' premium geometry boxes with 'spur gear' divider and compass for higher precision and several offerings in the pens, mechanical pencils and scholastics categories. The Business also scaled up presence in the value segment of the notebook industry through its brand 'Saathi' with a view to consolidating its leadership position.

Performance of the Lifestyle Retailing Business was adversely impacted during the year on account of a premature end to the Spring Summer 2017 season triggered by the transition to GST and most players in the industry announcing an early 'end of season sale' period which was also extended in a bid to liquidate pre-GST merchandise. On the other hand, e-commerce players continued with their aggressive push to capture market share amongst value seeking consumers by offering heavy discounts and launching exclusive labels and brands. The performance of the Lifestyle Retailing Business was adversely impacted against the backdrop of the challenging environment as aforestated.

The Business continued to execute the structural interventions initiated in the previous year across channels and processes including restructuring the retail foot print, rationalisation of stores, modifying the design language of its offerings, restructuring of terms of trade with business partners and sharpening working capital management. The Business refreshed the offers under Wills Lifestyle and John Players adopting a unique 'Story-based Looks creation' approach. This initiative entailed re-crafting the merchandise range architecture, channel specific offerings and special focus on enhancing the portfolio of core merchandise. Distinct & time bound colour stories were introduced aimed at providing freshness to consumers in the retail stores on a continual basis.

During the year, the Business enhanced its core portfolio, augmented marketing activities including windows and visual merchandising, improved manufacturing productivity and efficacy of replenishment mechanisms. Analytics based on ERP and point-of-sale systems enabled enhancing consumer experience besides further strengthening inventory and receivables management.

The Agarbatti category witnessed increase in competitive intensity during the year with industry players resorting to higher trade schemes in a bid to garner market share. The continued presence of counterfeit products and supply chain disruptions due to transition to GST also weighed on industry performance. Against the backdrop of these challenging conditions, Mangaldeep sustained its position as the leader in the Dhoop segment and the second largest brand in the Agarbatti segment. During the year, the Business strengthened its product portfolio with the launch of several new variants and enhanced its distribution reach. Investments in media coupled with on-ground activation activities were made during the year towards enhancing Mangaldeep's salience as the most preferred brand in the devotional space. Product mix enrichment and cost optimisation initiatives continued to be the other key focus areas for the Business.

While demand conditions remained sluggish during the year in the Safety Matches category, the Business sustained its leadership position by leveraging a robust portfolio of offerings across market segments and focusing on enriching its product mix.

Please refer to the FMCG - Others section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2017 and Media Releases on quarterly results for further details.

Q16. Please provide an update on the Cigarettes business.

Answer: A punitive and discriminatory taxation and regulatory regime continues to exert severe pressure on the domestic legal cigarette industry even as illegal cigarette trade grows unabated.

The legal cigarette industry, already reeling under the cumulative impact of steep increase in taxation over the last five years and intense regulatory pressures, was further impacted by the sharp upward revision in GST Compensation Cess announced in July 2017. Contrary to indications that the transition to GST would be based on the principle of maintaining revenue neutrality, tax incidence on cigarettes rose sharply by 13% with an even steeper increase of 19% for the king-size filter segment under the GST regime. Coupled with the increase in Excise Duty rates announced in the Union Budget 2017, this resulted in an incremental tax burden of over 20% on the Cigarette Business post implementation of GST.

It is pertinent to note that the tax incidence on cigarettes, after cognising for the latest increase in Cess rates, has nearly trebled over the last six years, on a comparable basis.

The Cigarette Business also had to contend with additional costs associated with the transition to GST due to non-availability of Additional Duty Surcharge credit on transition stocks and the unanticipated revision of GST Compensation Cess w.e.f. 18th July 2017 which impacted pipeline stocks.

In addition to being subjected to punitive taxation, cigarettes continue to be discriminated against in the GST regime. Even as a uniform GST rate of 28% has been made applicable to all tobacco products, the discriminatory tax incidence continues on account of differential rates of GST Compensation Cess. For example, a Specific GST Compensation Cess, at rates higher than the Central Excise Duty levied on cigarettes in the erstwhile regime, is levied on cigarettes in addition to an Ad-valorem GST Compensation Cess of 36% for king-size cigarettes and 5% for the other length segments. In comparison, no GST Compensation Cess is levied on bidis. Consequently, cigarette taxes remain, effectively, about 50 times higher than on other tobacco products.

While overall tobacco consumption in the country continues to grow, the share of duty-paid cigarettes has come down substantially over the years and is estimated to account for around 11% of current tobacco consumption in the country. Despite accounting for such a low share of overall tobacco consumption in the country, the legal cigarette industry contributes more than 87% of tax revenue from the tobacco sector. The other types of tobacco products contribute barely 13% of tax revenue from the tobacco sector despite accounting for 89% of total tobacco consumption. It is estimated that the exchequer is losing more than Rs. 13000 crores revenue annually on account of tax evasion on cigarettes alone. The loss to the exchequer is even higher when the evaded taxes on other tobacco products are also considered.

The high rates of tax on cigarettes also provide attractive tax arbitrage opportunities to unscrupulous players, fanning the growth of illegal cigarette trade in the country. While the legitimate cigarette industry has declined steadily since 2010-11 at a compound annual rate of 4.8% p.a., illegal cigarette volumes in contrast have grown at about 5% p.a. during the same period, making India one of the fastest growing illegal cigarette markets in the world. It is pertinent to note that, according to Euromonitor International, India is now the 4th largest illegal cigarette market in the world.

Another factor that fuels the growth of smuggled international brands is that such cigarette packs do not carry the excessively large (85% of the surface area of both sides of the cigarette package) pictorial warnings with extremely gruesome and unreasonable images that are prescribed under Indian laws. (Refer Q. no. 20 for impact of large GHW on Cigarette industry).

The attractive tax arbitrage opportunity for smuggled cigarettes allows unscrupulous players to make the products available to consumers at a fraction of the price of duty-paid domestic cigarettes. In fact, the affordability of illegal cigarettes and the other cheaper tobacco products (by reason of lower tax incidence as well as evasion of taxes) has been driving the consumption of tobacco from duty-paid cigarettes to the other forms.

The growth of smuggled international brands has also adversely impacted the demand for domestic Flue Cured Virginia (FCV) tobacco that is used in cigarette manufacture. The absence of a strong domestic demand base has not only resulted in loss of income but also exposed the Indian tobacco farmer to the volatilities of the international market, thereby sub-optimising earnings from tobacco crop exports as well. These developments have had a devastating impact on the Indian tobacco farmer and the 46 million livelihoods dependent on the tobacco value chain. Soft demand for Indian FCV tobacco has prompted the Tobacco Board of India to reduce the authorised crop size for three successive years i.e. 2015-16, 2016-17, 2017-18. Further, the unprecedented drought in Andhra Pradesh in late 2016 played havoc on the actual crop output in 2017 besides adversely impacting its quality. This, in turn, has also led to lower exports of tobacco. It is estimated that the cumulative drop in farmer earnings is in excess of Rs. 3450 crores over the last three years, i.e., an average loss in earnings of over Rs. 1150 crores per year.

As reported last year, ITC and several other stakeholders had challenged the validity of the pictorial warnings. Based on a direction of the Supreme Court, all litigation on pictorial warnings were tagged together and heard by the High Court of Karnataka. The High Court, by its judgement in December 2017 held the 85% pictorial warnings with extremely gruesome imagery to be factually incorrect and unconstitutional. Upon a Special Leave Petition filed by the Government, the Honourable Supreme Court stayed the Order of the High Court. Pending the final hearing of this matter, the regime of the extremely repugnant 85% pictorial warnings continues.

Although India is the 3rd largest Flue Cured Virginia tobacco grower in the world, it has put in place extremely stringent tobacco control laws. For instance, the statutorily prescribed pictorial warning occupying 85% of both sides of a cigarette pack ranks India in the 2nd position globally in terms of their stringency. Unfortunately, these laws have fuelled, albeit unintentionally, the growth of illegal cigarettes in the country and consequently, impacted adversely on farmer incomes. In contrast, several major tobacco producing countries, including the USA, have taken into consideration the interests of their tobacco farmers in deciding whether or not to adopt large or excessive pictorial warnings. The Indian tobacco control laws have, thus, had the inadvertent and unforeseen effect of causing losses to the Indian farmer with corresponding gains to tobacco farmers in the countries that have opted for moderate and equitable tobacco control laws.

Despite an extremely challenging operating environment, the Business consolidated its leadership position in the industry during the year and continued to improve its standing in key competitive markets across the country. This demonstrates the resilience of the Company's portfolio of brands, superior consumer insights and its relentless focus on value creation. Some of the key interventions during the year include the launch of innovative variants viz., Classic Double Burst, Gold Flake Mint Switch, Flake Mint Switch, Bristol Magnum, Navy Cut Century and a new brand, Wave. Additionally, two brands, American Club and Players, which were launched towards the end of 2016-17 were strengthened significantly during the year.

Unfortunately, the taxation and regulatory policies of the country are largely cigarette-centric and based on tobacco consumption patterns prevalent in developed countries. Such policies are not suitable for India since duty-paid cigarettes account for only about 11% of tobacco consumption in the country as compared to the global average of more than 90%. The Company continues to engage with policy makers for a tobacco taxation and regulatory policy that is non-discriminatory, helps combat the menace of illegal cigarettes and addresses the issues of all stakeholders, particularly tobacco farmers, Exchequer and consumers. Such a policy will not only help maximisation of the revenue potential of tobacco even in a shrinking basket of tobacco consumption but also address the tobacco control and health objectives of the Government.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2017 and Media Releases on quarterly results for further details.

Q17. Is the pressure on volumes similar across the different segments i.e. King Size filters, Longs, Regular filters and filter cigarettes of 'length not exceeding 65 mm'?

Answer: While all segments are witnessing pressure on volumes, the sub 65 mm segment is relatively less impacted.

Q18. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: As aforestated, the tax incidence on cigarettes, after cognising for the latest increase in Cess rates, has nearly trebled over the last six years, on a comparable basis.

As highlighted earlier, while overall tobacco consumption in the country continues to grow, the share of duty-paid cigarettes has come down substantially over the years and is estimated to account for around 11% of current tobacco consumption in the country. Despite accounting for such a low share of overall tobacco consumption in the country, the legal cigarette industry contributes more than 87% of tax revenue from the tobacco sector. The other types of tobacco products contribute barely 13% of tax revenue from the tobacco sector despite accounting for 89% of total tobacco consumption.

While this indicates room for growth in legal cigarette volumes going forward, this would largely depend on the taxation and regulatory policy on cigarettes adopted by the Government. Such growth potential was demonstrated during the period 2004/05 to 2006/07 and again, more recently, in 2009/10 and 2011/12 - years in which taxes / duties growth were moderate.

A stable, fair and equitable India-centric cigarette taxation and regulatory policy which recognises the unique tobacco consumption pattern in the country is critical to realising the full economic potential of the tobacco sector in India.

The Company continues to engage with the concerned authorities, both at the Central Government and State level, in this regard.

Q19. At what rate are Cigarettes taxed under the GST regime? What is the impact of GST on Cigarettes Business?

Answer: Cigarettes are exigible to tax under the GST regime at the peak rate of 28%. Additionally, a GST Compensation Cess which includes an Ad Valorem component and a Specific Tax component based on cigarette length, has also been imposed. The National Calamity Contingent Duty (NCCD) component of Excise Duty continues to be levied as earlier based on the length of the cigarette.

Please see response to question no. 16 for impact of GST on Cigarette Business.

Q20. What is the impact of the larger graphic health warnings on packs on the cigarette industry?

Answer: The 85% GHW is excessively large, extremely gruesome and unreasonable. There is no evidence that cigarette smoking would cause the diseases depicted in the pictures or that large GHW will lead to reduction in consumption. The large GHW fuels the growth of smuggled international brands as such cigarette packs do not carry the excessively large (85% of the surface area of both sides of the cigarette package) pictorial warnings with extremely gruesome and unreasonable images that are prescribed under Indian laws. While the legal cigarette industry scrupulously complies with the statutory provisions, smuggled international brands of cigarettes either do not bear any pictorial or other health warnings or bear warnings of much smaller dimensions, that too different from what is mandated under Indian law. Findings from research conducted by IMRB International, an independent organisation, indicate that the lack of warnings or their diminutive size creates a perception in the consumer's mind that the smuggled cigarettes are 'safer' than domestic duty-paid cigarettes that carry the statutory warnings.

It is pertinent to note that the global average size of pictorial warnings is only about 30% coverage of the principal display area. In fact, the three countries that account for about 51% of the world's cigarette consumption, viz., USA, Japan and China have not adopted pictorial / graphical warnings and have prescribed only text-based warnings on cigarette packages. The statutorily prescribed pictorial warning occupying 85% of both sides of a cigarette pack ranks India in the 2nd position globally in terms of their stringency1 Unfortunately, these laws have fuelled, albeit unintentionally, the growth of illegal cigarettes in the country.

The excessively large GHWs prevent consumers from making an informed choice in a competitive market, since they are denied adequate information about the brand on the cigarette packages. The Company believes that such GHW also devalues the Intellectual Property Rights of brand owners and sub-optimises the large investments made over the years in creating and nurturing the brands.

Q21. Please provide an update on the Karnataka High Court order relating to 85% graphic health warnings on tobacco product packages.

Answer: As reported last year, the Company and several other stakeholders had challenged the validity of the pictorial warnings. Based on a direction of the Honourable Supreme Court, all litigation on pictorial warnings were tagged together and heard by the High Court of Karnataka. The High Court, by its judgement in December 2017 held the 85% pictorial warnings with extremely gruesome imagery to be factually incorrect and unconstitutional. Upon a Special Leave Petition filed by the Government, the Honourable Supreme Court stayed the Order of the High Court. Pending the final hearing of this matter, the regime of the extremely repugnant 85% pictorial warnings continues.

Q22. What are the Company's plans in the 'other tobacco and nicotine products' space?

Answer: During the year, the Electronic Vaping Devices portfolio was augmented with the launch of EON Myx, a disposable variant which is offered in adult flavours like coffee in addition to menthol and full flavour. The consumer response to this offering has been encouraging. The rechargeable variant, EON Charge, further strengthened its performance during the year. Given the nascent state of the market and the evolving regulatory oversight globally, the Company remains engaged with the policy makers for adoption of an appropriate and equitable regulatory framework in India for this category. The research and development initiatives of the Company continue to add to the country's bank of Intellectual Property Rights (IPR). In addition to grant of several patents in previous years, the Company was granted three more patents during the year - two international and one national - in respect of cigarettes.

Q23. Please provide an update on the Company's Hotels business

Answer: The operating environment in the hospitality sector showed signs of improvement with foreign tourist arrivals crossing the 10 million mark in 2017. While growth in Segment Revenue during the year was subdued at 5.6% reflecting inter alia the overhang of excess room inventory and the impact of highway liquor ban, performance during the second half was significantly better driven by increase in ARR and robust growth in Food & Beverage revenue. Improvement in room rates and operating leverage aided faster growth of 26% in Segment Results, notwithstanding the gestation costs of ITC Grand Bharat and the recently commissioned WelcomHotel Coimbatore.

In view of the long-term potential of the Indian hospitality sector, the Company remains committed to enhancing the scale of the Business by adopting an 'asset-right' strategy that envisages building world-class tourism assets for the nation and growing the footprint of managed properties by leveraging its hotel management expertise. The Business made steady progress during the year in the construction of luxury hotels at Hyderabad, Kolkata and Ahmedabad. ITC Kohenur, offering world-class luxury in picturesque settings right in the busy IT Hub of Hyderabad, has just been commissioned on June 1, 2018. In addition, the Company's wholly-owned subsidiary in Sri Lanka made steady progress towards setting up a luxury hotel christened 'ITC One' and a super-premium residential apartment complex, 'Sapphire Residences - Colombo 1', situated at a strategic location in Colombo.

As reported earlier, the Company was declared the successful bidder for a 250-room luxury beach resort located in South Goa operating under the name Park Hyatt Goa Resort and Spa, following an auction held by IFCI Limited in February 2015 in terms of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. Subsequent to making full payment of the bid amount, IFCI issued the requisite Sale Certificates in favour of the Company on 25th February, 2015. However, based on an appeal by the erstwhile owners, the sale had been struck down by the Honourable Bombay High Court. The Company and IFCI had contested the said order before the Honourable Supreme Court. On 19th March, 2018, the Honourable Supreme Court upheld the sale of the property by IFCI Limited to the Company and directed that the hotel property be handed over within six months. Accordingly, the property is expected to be handed over in the coming months.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2017 and Media Releases on quarterly results for further details.

Q24. Please provide an update on the Company's Agri Business

Answer: Indian FCV crop output at 212 million kgs., was lower by five million kgs. over the previous year mainly on account of the Tobacco Board's decision to reduce the authorised crop size and unprecedented drought in Andhra Pradesh in 2016. This marked the third successive year of decline representing a cumulative drop of 19% over 2015. Crop output in Andhra Pradesh reduced to 106 million kgs. - the lowest level in a decade, while quality was also adversely impacted.

Reduction in crop size over the years, shortage & poor quality of Andhra 2017 crop, lower export incentives and availability of Chinese inventory at discounted prices led to significant pressure on Indian tobacco exports. Sustained pressure on cigarette sales volumes, both in India and globally, coupled with relative strength of the Indian Rupee compared to competing country currencies also resulted in reduced demand for Indian tobaccos. The combination of the factors as aforestated led to the fourth successive year of decline in Indian tobacco exports to 178 million kgs. - a ten-year low.

Despite such challenging market conditions, the Company consolidated its leadership position as the largest Indian exporter of unmanufactured tobacco with further improvement in market standing. This was achieved through new business development and enhanced value delivery to existing customers by leveraging the Business's expertise in crop development, superior leaf procurement processes and world-class processing facilities. The Business continued to provide strategic sourcing support to the Cigarette Business meeting all requirements at competitive prices.

During 2017-18, world wheat output increased by eight million tonnes to about 758 million tonnes mainly due to higher production in Russia. India also witnessed higher production by six million tonnes which led to increase in government procurement by eight million tonnes thereby reducing the surplus available for domestic trade. This led to exports from India being uncompetitive compared to other origins like Russia and Ukraine. These circumstances resulted in lack of trading opportunities in wheat during the year both in the export and domestic markets.

The deep rural linkages and expertise in agri-commodity sourcing resident in the Agri Business, coupled with differentiation through value-added services of identity preservation, traceability and certification is a critical source of competitive advantage the Company. The Business continues to provide strategic sourcing support to the Company's Cigarette business and sources identity-preserved specific grades of superior quality wheat, fruit pulp, spices and frozen shrimps for the Branded Packaged Foods Businesses.

The year also marked the Company's foray into branded packaged potatoes and apples under the 'Farmland' brand in select cities for the retail segment. The product portfolio comprises a range of differentiated offerings such as low sugar, antioxidant, french fry and baby potatoes, and apples sourced from Jammu & Kashmir and Himachal Pradesh. The Business also launched 'ITC Master Chef - Smart Onions', a dehydrated onion product, in select markets for the domestic food service segment. The product is anchored on delivering the benefits of convenient and faster cooking with less oil and adheres to global standards in safety. The aforestated initiatives have met with encouraging response and are planned to be scaled up going forward.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2017 and Media Releases on quarterly results for further details.

Q25. Please provide an update on the Company's Paperboards, Paper and Packaging Segment

Answer: The domestic Paperboards, Paper and Packaging industry remained impacted by sluggish demand conditions prevailing in the FMCG, liquor and legal cigarette industry. The transition to GST also caused short term disruptions especially during the first half of the year. This, coupled with zero duty imports under ASEAN Free Trade Agreement, cheap imports from China and unabsorbed capacity in the industry weighed on the performance of the Business. On the positive side, relatively benign input costs, higher substitution of imported pulp with in-house pulp and continued focus on product mix enrichment resulted in margin expansion. Consequently, while Segment Revenue de-grew by 2.1%, Segment Results grew at a faster pace of 7.9% during the year.

The Business remains the clear leader in the VAP segment and continues to consolidate its preferred supplier status amongst leading end-use customers and brands. Further, the expansion project in the VAP segment at Bhadrachalam unit is nearing completion. The Specialty Papers portfolio was also expanded with the launch of new grades to service the needs of customers. The Décor machine at Tribeni unit was completely refurbished during the year, incorporating latest technology features along with capacity expansion. The Business sustained its leadership position in the sale of eco-labelled products, volumes of which grew by appx. 12% during the year.

The Business continues to make structural interventions in the areas of strategic cost management and import substitution. These include augmentation of in-house pulp manufacturing capacity, efficiency improvements of existing equipment and developing alternative sources of supply for key inputs on an ongoing basis. Operations of the Bleached Chemical Thermo Mechanical Pulp mill (BCTMP) at the Bhadrachalam unit stabilised during the year with progressive improvement in capacity utilisation leading to reduced dependence on imported pulp and cost savings. During the year, technology interventions made in the pulp mill resulted in higher pulp production, improvement in pulp quality and reduction in chemical consumption.

The Packaging and Printing Business further consolidated its position as a 'one-stop shop for packaging solutions' leveraging the recent investments in rigid boxes and flexo corrugated packaging lines. With its comprehensive capability-set across multiple platforms, coupled with in-house cylinder making and blown film manufacturing lines, the Business continues to provide innovative solutions to several key customers in India and overseas, catering to the packaging requirements across several industry segments viz. Food & Beverage, Personal Care, Home care, Apparel, Consumer Electronics, Pharma, Liquor and Tobacco. The Business continued to provide strategic support to the Cigarette and FMCG businesses.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2017 and Media Releases on quarterly results for further details.

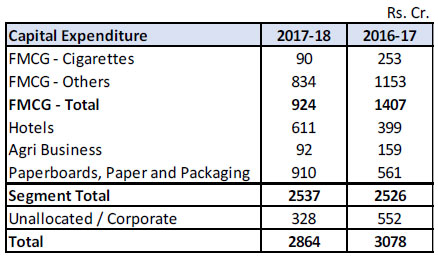

Q26. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last two financial years is tabulated below:

Q27. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan going forward is to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Currently, over 15 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

In the Hotels Business, the Company is progressing the construction of new hotels in Kolkata and Ahmedabad. Besides, WelcomHotels Lanka Private Ltd. - a wholly-owned subsidiary of the Company is in the process of setting up a luxury hotel christened 'ITC One' and a super-premium residential apartment complex, 'Sapphire Residences - Colombo 1' at a strategic location in Colombo.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards capacity augmentation/machine rebuild at the Bhadrachalam unit and capacity augmentation in Cartons and Flexibles packaging at the Tiruvottiyur unit.

Overall, the Company estimates capex of around Rs. 19000 crores over the next 5 years (excluding investments for inorganic growth and acquisition of trademarks, other intellectual property, etc.). However, this would depend on several factors such as pick-up in economic activity and improvement in demand conditions, timely acquisition of land at desirable locations, obtaining approvals from the concerned authorities in a timely manner etc.

Q28. Why has the Segment Capital Employed decreased by Rs. 1302.43 crores from Rs. 23810.19 crores as at 31st March 2017 to Rs. 22507.76 crores as at 31st March 2018?

Answer: The decrease in Segment Capital Employed was primarily on account of incremental GST liability, higher trade payables partly offset by higher Net Fixed Assets (net of depreciation) towards capacity augmentation in FMCG businesses, ongoing investments in Hotels, and cost reduction related investments in Paperboards, Paper and Packaging business.

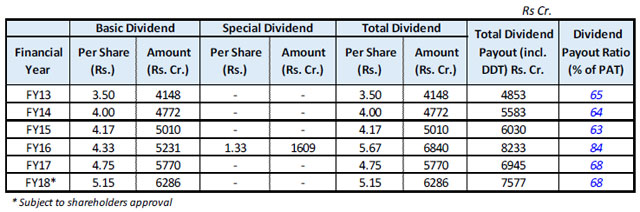

Q29. What are the dividend payout trends in recent years? What is the Dividend policy of the Company?

Answer: Dividend paid out by the Company for the last 5 years is given below:

Please refer to the following link for the Dividend Distribution policy of the Company.

http://www.itcportal.com/about-itc/policies/dividend-distribution-policy.pdf

Q30. Please explain the Company's 'Triple Bottom Line' philosophy.

Answer: Inspired by the opportunity to sub-serve larger national priorities, the Company redefined its Vision to not only reposition the organisation for extreme competitiveness but also make societal value creation the bedrock of its corporate strategy. This super-ordinate Vision spurred innovative strategies to address some of the most challenging societal issues including widespread poverty, unemployment and environmental degradation. The Company's sustainability strategy aims at creating significant value for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and social capital. The sustainability strategy is premised on the belief that the transformational capacity of business can be very effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

The Company is today a global exemplar in sustainability. It is a matter of immense satisfaction that its models of sustainable development have led to the creation of sustainable livelihoods for around six million people, many of whom belong to the marginalised sections of society. The Company has also sustained its position of being the only Company in the world of comparable dimensions to have achieved the global environmental distinction of being carbon positive (for 13 consecutive years), water positive (for 16 years in a row) and solid waste recycling positive (for 11 years in succession).

To contribute to the nation's efforts in combating climate change, the Company's strategy of adopting a low-carbon growth path is manifest in its growing renewable energy portfolio, establishment of green buildings, large-scale afforestation programme and achievement of international benchmarks in energy and water consumption. During the year, over 43% of the Company's total energy requirements were met from renewable energy sources - a creditable performance given its expanding manufacturing base. In addition, the practice of ensuring that premium luxury hotels, office complexes and factories of the Company are certified at the highest level by the US Green Building Council / Indian Green Building Council and the Bureau of Energy Efficiency (BEE) continues.

The Company has adopted a comprehensive set of sustainability policies that are being implemented across the organisation in pursuit of its 'Triple Bottom Line' agenda. These policies are aimed at strengthening the mechanisms of engagement with key stakeholders, identification of material sustainability issues and progressively monitoring and mitigating the impacts along the value chain of each Business.

The Company's 14th Sustainability Report, published during the year detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2016-17. This report is in conformance with the Global Reporting Initiative (GRI) Guidelines - G4 under 'In Accordance - Comprehensive' category and is third-party assured at the highest criteria of 'reasonable assurance' as per International Standard on Assurance Engagements (ISAE) 3000. The 15th Sustainability Report, covering the sustainability performance for the year 2017-18, is being prepared in accordance with the GRI Standards and will be made available shortly.

In addition, the Business Responsibility Report (BRR), as mandated by the Securities & Exchange Board of India (SEBI), was brought out as an annexure to the Report and Accounts 2017, mapping the sustainability performance against the reporting framework suggested by SEBI.

Q31. Please provide an update of the Company's Corporate Social Responsibility Programme.

Answer: The Company's Social Investments Programme aims to address the challenges arising out of poverty, environmental degradation and climate change through a range of activities with the overarching objective of creating sustainable sources of livelihood for stakeholders.

The footprint of the Company's CSR programme can be viewed at a glance in the following chart:

| Intervention Areas | Unit of Measurement | Cumulative till date |

| Social and Farm Forestry Soil and Moisture Conservation Programme | Acre Acre | 686,519 874,496 |

| Sustainable Agricultural Practices Compost Units Sustainable Agriculture Program | Number Acre | 37,530 415,000 |

| Sustainable Livelihoods Initiative Cattle Development Centres Animal Husbandry Services | Number Artificial Inseminations (in lakhs) | 211 22.21 |

| Economic Empowerment of Women Ultra Poor Women covered Self Help Group Members Livelihoods created | Number Number Number | 20,100 37,584 61,106 |

| Primary Education Children covered | Number (in lakhs) | 5.59 |

| Health and Sanitation Low Cost Sanitary Units Households covered under Solid Waste Management | Number Number | 31,473 98,038 |

| Vocational Training Students Enrolled | Number | 55,324 |

1 Cigarette Package Health Warnings - International Status Report, 5th Edition, October 2016, Canadian Cancer Society.